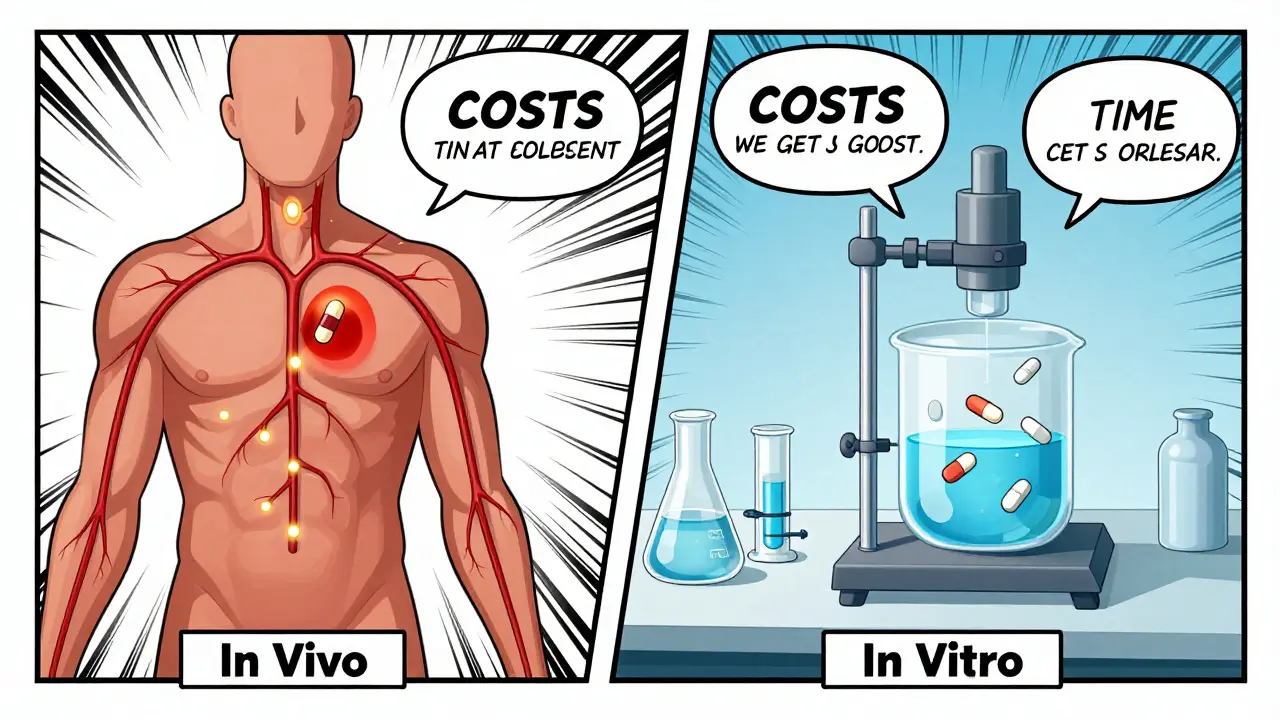

When a generic drug hits the shelves, you might assume it’s just a cheaper copy of the brand-name version. But behind that simple label is a complex science designed to prove it works the same way in your body. That’s where bioequivalence testing comes in. It’s not about taste or color-it’s about whether the drug gets into your bloodstream at the same rate and amount as the original. And there are two main ways to prove it: in vivo and in vitro testing. Knowing when each one is used can help you understand why some generics are approved faster, cheaper, or with more scrutiny than others.

What In Vivo Bioequivalence Testing Actually Means

In vivo means "within the living." In this case, it means testing the drug in real human volunteers. The gold standard is a crossover study: 24 healthy adults take the generic version one time, then after a washout period, take the brand-name version. Blood samples are taken over several hours to measure how much of the drug enters the bloodstream and how quickly. The two key numbers are Cmax (peak concentration) and AUC (total exposure over time). For the drugs to be considered bioequivalent, the 90% confidence interval for both values must fall between 80% and 125% of the brand-name drug. For narrow therapeutic index drugs like warfarin or levothyroxine, that range tightens to 90%-111.11% because even small differences can cause serious side effects.This method is direct. It measures what actually happens inside a human body-absorption, metabolism, and elimination. But it’s expensive. A single in vivo study can cost between $500,000 and $1 million. It takes 3 to 6 months from planning to approval, including ethics reviews, subject recruitment, and clinical site setup. The FDA requires these studies to be done in certified clinical research units with electronic data systems that meet 21 CFR Part 11 standards. That’s not just paperwork-it’s a whole infrastructure.

How In Vitro Testing Works (And Why It’s Gaining Ground)

In vitro means "in glass." No humans involved. Instead, scientists test the drug’s physical and chemical properties in a lab. The most common method is dissolution testing: placing the tablet or capsule in a fluid that mimics stomach or intestinal conditions, then measuring how fast the drug dissolves. For inhalers, they measure droplet size and drug delivery per puff. For creams, they check how much drug is released from the base over time.These tests are precise. Dissolution results often have a coefficient of variation under 5%, compared to 10-20% in human studies. That means less noise, more control. And they’re fast. A well-developed in vitro method can be completed in 2 to 4 weeks. The cost? Around $50,000 to $150,000-roughly one-tenth of an in vivo study.

But here’s the catch: in vitro tests don’t measure what happens in the body. They measure what happens in a beaker. That’s why regulators only accept them under specific conditions. The FDA allows in vitro methods to replace human studies for certain drugs-especially those classified as BCS Class I: high solubility, high permeability. For these drugs, dissolution rate directly predicts absorption. In 2021, the FDA granted biowaivers (approval without in vivo testing) to 78% of BCS Class I generic applications.

When In Vitro Testing Is the Clear Choice

There are four main situations where in vitro testing isn’t just convenient-it’s the only practical option.First, for complex delivery systems like metered-dose inhalers and nasal sprays. Getting 24 people to inhale a drug correctly, consistently, and safely is nearly impossible. One puff too shallow, one too deep, and the data is ruined. In vitro cascade impactor testing measures particle size and drug delivery with laser precision. The FDA approved Teva’s generic budesonide nasal spray in October 2022 based solely on in vitro data-a landmark decision.

Second, for topical products like antifungal creams or steroid ointments. These drugs act locally on the skin. What matters isn’t how much enters the bloodstream-it’s how much stays on the skin and works. Plasma levels are irrelevant. In vitro release testing is the standard here.

Third, when there’s a validated in vitro-in vivo correlation (IVIVC). This is a mathematical model that links lab dissolution results to actual human absorption. If the model’s correlation coefficient (r²) is above 0.95, regulators trust it. Modified-release theophylline products have successfully used this approach for years.

Fourth, for drugs with high solubility and permeability (BCS Class I). For these, dissolution is the best predictor of performance. No need to test in humans if the drug dissolves the same way every time.

When In Vivo Testing Is Non-Negotiable

Even with all the advances in lab testing, there are still cases where human studies can’t be replaced.First, narrow therapeutic index drugs. These are drugs where a tiny change in blood level can mean the difference between healing and harm. Warfarin, digoxin, phenytoin, and levothyroxine fall into this category. In vitro methods can’t reliably detect the small differences that matter here. The FDA still requires in vivo studies for these.

Second, drugs affected by food. Some drugs absorb better with food, others worse. To cover all bases, regulators require both fasting and fed-state studies. You can’t simulate a full stomach in a beaker.

Third, drugs with nonlinear pharmacokinetics. If doubling the dose doesn’t double the blood level-because metabolism saturates or transporters get overwhelmed-in vitro models can’t predict this. Only human data can capture that complexity.

Fourth, when the drug’s site of action isn’t systemic. For example, drugs that work in the gut, like certain laxatives or antibiotics targeting C. diff, don’t need to enter the bloodstream. Plasma levels are meaningless. In vivo testing here looks at local effects, not absorption.

The Real-World Trade-Offs: Cost, Time, and Risk

Manufacturers aren’t choosing between methods because they prefer one over the other-they’re choosing based on risk and resources.Take a BCS Class I drug. A company might spend 3 months developing a perfect dissolution method. That’s time and money upfront. But once approved, future batches can be tested quickly and cheaply. One pharmaceutical company saved $1.2 million and 8 months by using in vitro testing instead of human trials. But if the method fails FDA review? That’s a year lost.

On the flip side, a topical antifungal cream approved via in vitro testing once faced post-market complaints about reduced effectiveness. The company had to run a costly in vivo study later-$850,000 and 11 months delayed. Why? Because in vitro tests didn’t capture how the drug behaved on real skin with varying moisture, thickness, or microbial load.

Regulatory uncertainty is real. While the FDA has clear guidelines for oral solids and inhalers, there’s still ambiguity for newer products like transdermal patches or complex gels. Many companies report spending months in pre-submission meetings just to get approval for their in vitro method.

What’s Next? The Future of Bioequivalence Testing

The trend is clear: more in vitro, less in vivo. The FDA’s 2020-2025 Strategic Plan prioritizes novel approaches, and the agency has already approved 214 biowaivers based on in vitro data in 2022 alone. The European Medicines Agency and Japan’s PMDA have followed suit. Harmonization through ICH means global acceptance for BCS Class I drugs.But the future isn’t just about lab tests. It’s about modeling. Physiologically based pharmacokinetic (PBPK) models now simulate how a drug moves through the body based on anatomy, enzyme activity, and gut pH. The FDA accepted PBPK modeling for some modified-release products in 2023. Imagine a digital twin of a human gut predicting absorption without ever touching a human subject.

By 2025, the FDA plans to issue two new guidances on in vitro testing for complex products. The goal? To make in vitro testing the default for most generics-with in vivo studies reserved for the highest-risk cases. That’s a shift from 95% in vivo in 2020 to a future where in vitro leads for 70% or more of approvals.

For patients, this means faster access to affordable drugs. For manufacturers, it means lower costs and quicker time to market. For regulators, it means more reliable, reproducible data. But it also means greater responsibility: every in vitro method must be rigorously validated. Because if the beaker doesn’t lie, it also doesn’t always tell the whole story.

Can in vitro testing replace in vivo testing for all generic drugs?

No. In vitro testing is only accepted for specific drug types: BCS Class I oral solids, certain inhalers, nasal sprays, and topical products with validated methods. For narrow therapeutic index drugs, those with food effects, or drugs with nonlinear absorption, in vivo testing remains required by the FDA and EMA.

Why is in vitro testing cheaper than in vivo testing?

In vitro testing doesn’t require human subjects, clinical sites, or long-term monitoring. A single in vivo study costs $500,000-$1 million and takes 3-6 months. In vitro testing costs $50,000-$150,000 and can be completed in 2-4 weeks. The main expense in in vitro is method development, not execution.

What is a biowaiver, and how does it relate to in vitro testing?

A biowaiver is when regulators allow a generic drug to be approved without conducting an in vivo bioequivalence study. This is granted when in vitro data (like dissolution profiles) and scientific evidence (such as BCS classification) prove the drug will behave the same in the body. Most biowaivers are for BCS Class I drugs.

How accurate is in vitro testing at predicting real-world performance?

For BCS Class I drugs, in vitro dissolution correctly predicts bioequivalence in 92% of cases. For BCS Class III drugs (high solubility, low permeability), accuracy drops to 65%. This is because permeability-how well the drug crosses cell membranes-is hard to simulate in a lab. That’s why in vivo testing is still needed for many drugs.

Are in vitro methods accepted worldwide?

Yes. The U.S. FDA, European Medicines Agency (EMA), and Japan’s PMDA all accept in vitro bioequivalence testing under similar conditions, especially for BCS Class I drugs. Harmonization through the International Council for Harmonisation (ICH) has made global approval more consistent.

What’s the biggest challenge in using in vitro methods?

The biggest challenge is method development. Creating a dissolution or particle size test that reliably predicts human performance takes months of work, specialized equipment (like USP Apparatus 4 flow-through cells, costing $85,000-$120,000), and deep expertise in biopharmaceutics. Many companies fail their first submission because the method isn’t robust enough.

Final Thoughts: It’s Not Either/Or-It’s Right Tool, Right Drug

The choice between in vivo and in vitro testing isn’t about which is better. It’s about which is appropriate. For a simple, well-understood drug like ibuprofen, in vitro testing is faster, cheaper, and just as reliable. For a life-saving drug like warfarin, human data is non-negotiable. The system isn’t broken-it’s evolving. As modeling improves and regulatory science advances, we’re moving toward smarter, more targeted testing. That means safer generics, quicker access, and fewer unnecessary human trials. The future of bioequivalence isn’t about replacing humans with machines. It’s about using science to know exactly when you still need them.11 Comments

Jerian Lewis

January 9, 2026 at 09:48 AM

People act like in vitro is some kind of scientific revolution, but it's just corporate cost-cutting dressed up as progress. You can't simulate human biology in a beaker and call it reliable. This is how we get post-market recalls.

tali murah

January 10, 2026 at 19:17 PM

Oh wow. So now we’re trusting dissolution curves over actual human physiology? Brilliant. Next they’ll approve insulin based on a pH test and call it a day. The FDA’s ‘innovation’ is just regulatory surrender wrapped in PowerPoint slides.

Aron Veldhuizen

January 12, 2026 at 15:21 PM

You’re all missing the point. The real question isn’t whether in vitro works-it’s whether we’ve surrendered our moral obligation to test on humans. If we’re okay with beakers replacing bodies, what’s next? AI diagnosing cancer via spreadsheet? This isn’t science-it’s dehumanization with a lab coat.

Pooja Kumari

January 14, 2026 at 06:02 AM

Look, I get it-everyone’s excited about saving money and time, but let’s not pretend this is all sunshine and rainbows. I work in a clinical lab in Delhi, and we’ve had patients come in with generics that just… don’t work. Not because they’re fake, but because the dissolution profile looked perfect on paper but didn’t account for how their gut actually processes it. One guy on levothyroxine had his TSH go haywire because the generic dissolved too fast-he was dizzy, sweating, heart racing. The lab said ‘within specs.’ I said ‘this man is not a number.’ In vitro is great for ibuprofen, sure. But when your life depends on steady blood levels? You want flesh and blood, not a beaker. And don’t even get me started on how some companies tweak dissolution curves just to pass. It’s not science-it’s gaming the system. The FDA’s guidelines are good, but enforcement? Barely there. We need more post-market surveillance, not fewer human trials. And if you think PBPK models are going to replace all in vivo testing soon… you’re dreaming. The human body is messy, unpredictable, and beautiful. You can’t model that with a spreadsheet.

Ian Long

January 15, 2026 at 01:13 AM

Both methods have their place. In vitro saves time and money, sure-but it’s not a magic bullet. The real win is using them together. Like, build a solid dissolution profile, then validate it with a small, targeted human study. That’s the sweet spot. No need to test 24 people for every single batch, but also no need to trust a machine over biology. We’re over-indexing on efficiency and forgetting safety. Balance, people. Balance.

Jacob Paterson

January 16, 2026 at 17:58 PM

Oh please. You think in vitro is the future? Tell that to the guy whose generic warfarin made him bleed out because the dissolution profile was ‘within range’ but the polymorph form was different. The body doesn’t care about your fancy statistical confidence intervals. It cares about what actually happens. This whole push for biowaivers is corporate greed masquerading as innovation. Next they’ll approve antidepressants based on a tablet dissolving in Sprite.

Johanna Baxter

January 17, 2026 at 02:13 AM

in vitro = cheaper = more generics = more people can afford meds = good right?? why are yall so scared of progress??

Patty Walters

January 18, 2026 at 04:59 AM

Hey, I’m a pharmacist and I’ve seen both sides. In vitro is great for simple stuff-ibuprofen, metformin, all that. But for things like antifungal creams? Yeah, release rate matters, but so does skin type, sweat, pH, even how much you rub it in. I’ve had patients say their cream just… stopped working. Turned out the generic had the same dissolution profile but a different emulsifier. Skin doesn’t care about your USP apparatus. You need real-world data. Don’t throw out in vivo just because it’s expensive. It’s not the problem-the lack of post-market checks is.

Jenci Spradlin

January 19, 2026 at 17:19 PM

just want to say i used a generic budesonide inhaler last year and it felt totally different than the brand. not sure if it was the propellant or the particle size but i had to switch back. in vitro might be good on paper but if it doesn't feel right in your lungs, something's off.

RAJAT KD

January 20, 2026 at 12:58 PM

Exactly. That’s what I’ve been saying. A dissolution profile can’t capture how a patient actually uses the inhaler. Technique matters. Pressure. Breath hold. Timing. In vitro tests assume perfect use. Real people? They’re tired. They’re distracted. They’re kids or elderly. That’s why we need *some* in vivo validation-even for inhalers. The FDA’s approval of Teva’s spray was a step forward, but it’s not a finish line. We need post-market pharmacovigilance built into the system, not tacked on after the fact.

RAJAT KD

January 9, 2026 at 06:01 AM

In vitro testing for BCS Class I drugs? Absolutely. But don't let big pharma trick you into thinking it's foolproof. I've seen labs skip validation just to cut costs, and patients pay the price.