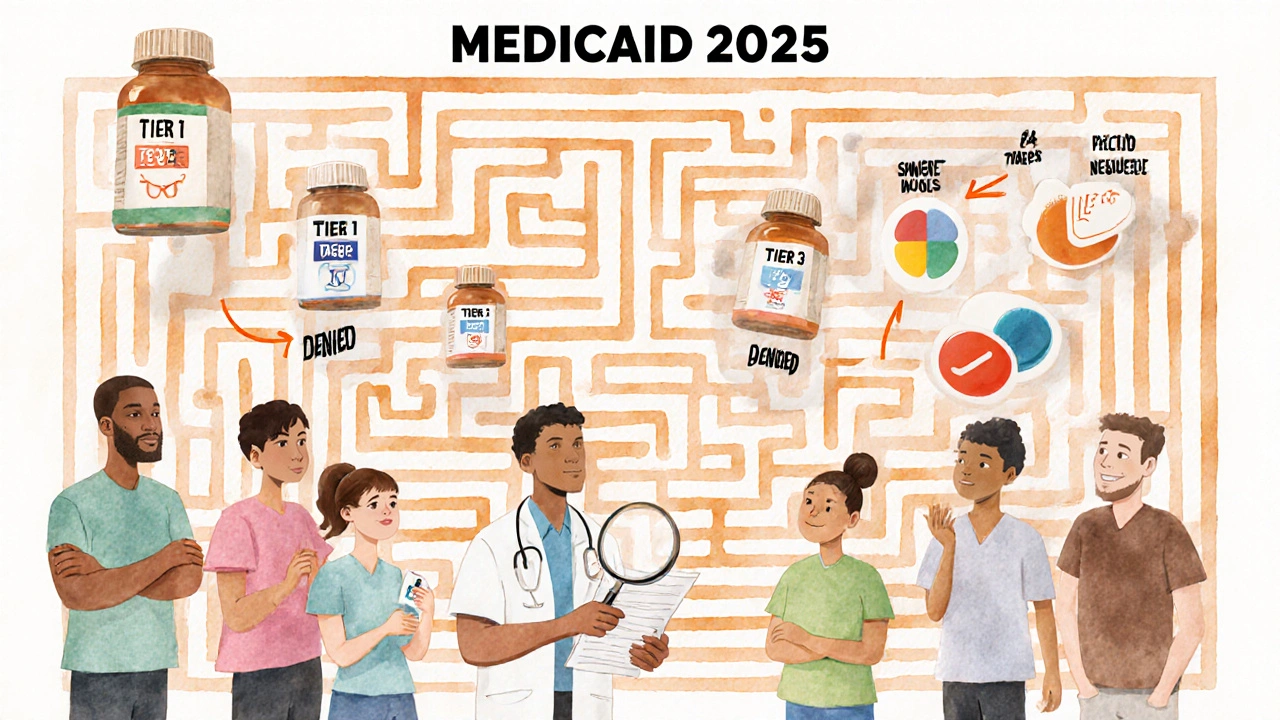

When you’re on Medicaid, getting your prescriptions shouldn’t mean choosing between medicine and rent. But understanding what’s covered - and what’s not - can feel like navigating a maze. In 2025, Medicaid covers outpatient prescription drugs for nearly 85 million low-income Americans, but the details vary wildly from state to state. What’s covered in North Carolina isn’t exactly the same as in Florida, even if both states follow federal rules. So what does Medicaid actually pay for? And why does your doctor have to jump through so many hoops just to get you the right pill?

Medicaid Covers Almost All Prescriptions - But Not Always the One You Want

By law, Medicaid doesn’t have to cover prescription drugs. But every state does - because it’s cheaper not to. Without drug coverage, people end up in emergency rooms with uncontrolled diabetes, asthma attacks, or infections that could’ve been treated with a simple antibiotic. So all 50 states and D.C. provide outpatient prescription drug coverage to nearly all Medicaid enrollees.

But here’s the catch: Medicaid doesn’t cover every single drug on the market. Instead, each state builds its own Preferred Drug List (PDL), also called a formulary. This list sorts medications into tiers based on cost, effectiveness, and how much rebate the drugmaker gives the state. The goal? Keep drugs affordable without cutting off access to essential treatments.

Tier 1 usually includes generics - the cheapest option. Think metformin for diabetes or lisinopril for high blood pressure. These often cost you $1 to $5 per prescription. Tier 2 is for brand-name drugs that don’t have a generic yet. You’ll pay more here - maybe $20 to $40. Tier 3? That’s where specialty drugs live: expensive treatments for cancer, hepatitis C, or rheumatoid arthritis. These can cost hundreds or even thousands, and getting them requires extra steps.

Step Therapy: You Have to Try the Cheaper Stuff First

Ever been told to try two other meds before they’ll approve the one your doctor picked? That’s step therapy - or “trial and failure.” It’s common in 38 states, including North Carolina and Florida. If your doctor prescribes a non-preferred drug, Medicaid might deny it unless you’ve already tried - and failed - at least two preferred alternatives.

For example, if you have depression and your doctor wants to prescribe Wellbutrin XL, Medicaid might require you to try two SSRIs like sertraline and escitalopram first. Even if those didn’t work for you before, you might have to go through the motions again. The system assumes that if a cheaper drug works, why pay more?

But this isn’t always safe or practical. Some patients with bipolar disorder, PTSD, or severe anxiety can’t safely cycle through multiple antidepressants. That’s why exceptions exist: if your doctor submits a detailed note explaining why step therapy won’t work for you - maybe due to past side effects, allergies, or documented treatment failure - Medicaid must review it. In North Carolina, 78% of denied prior authorizations get overturned when doctors include full clinical notes.

Prior Authorization: The Paperwork Hurdle

Some drugs require prior authorization - a formal request from your doctor to prove you need the medication. This isn’t just a form. It often needs lab results, diagnosis codes, proof you tried other options, and sometimes even letters from specialists.

For instance, if you have Type 1 Diabetes and need premixed rapid-acting insulin, North Carolina Medicaid allows prior authorization to last up to three years - if your doctor documents why you can’t use cheaper alternatives. But for other drugs like Epidiolex® (a CBD-based epilepsy treatment), coverage changed in July 2025: it moved from “preferred” to “non-preferred,” meaning you now need prior authorization even if you’ve used it successfully for years.

Processing times vary. The Medicare Rights Center found that initial requests take an average of 7.2 business days. Appeals? Nearly two weeks. That’s a long time if you’re running out of pills. And if your pharmacy doesn’t have the drug in stock, or your doctor’s office is slow to submit paperwork, you could go without.

What’s Not Covered? The List Keeps Changing

Medicaid formularies aren’t static. They change every few months - sometimes without warning. In October 2025, North Carolina removed nine drugs from its list entirely because they no longer qualified for federal rebates. That includes medications like Trulance (for constipation), Vanos Cream (for skin inflammation), and Uceris (for ulcerative colitis). If you were taking one of those, your pharmacy might have told you it’s no longer covered.

These removals aren’t random. They’re driven by money. If a drugmaker stops offering a big enough rebate to the state, Medicaid drops it. The state doesn’t say, “This drug is unsafe.” They say, “We can’t afford it.”

Some drugs are never covered at all. Over-the-counter medicines like ibuprofen or allergy pills? Not covered unless prescribed for a specific condition and approved through prior authorization. Weight-loss drugs like Ozempic or Wegovy? Almost never covered under standard Medicaid - even if your doctor says you need them for diabetes or heart disease. And fertility drugs? Usually excluded.

Extra Help: Lower Costs If You Qualify

If you have full Medicaid coverage, you automatically qualify for Extra Help - a federal program that slashes your out-of-pocket drug costs. In 2025, that means:

- $0 monthly premium

- $0 deductible

- Maximum $4.90 copay for generics

- Maximum $12.15 for brand-name drugs

Once you hit $2,000 in total drug costs for the year, you pay nothing for the rest of the year. And here’s the kicker: 1.2 million people who qualify for Extra Help don’t even know it. They’re paying full price because no one told them they’re eligible.

Medicaid enrollees don’t need to apply. If you’re on Medicaid, you’re enrolled in Extra Help automatically. Check your pharmacy receipt - if your copay is under $5 for a generic, you’re already getting it.

How to Get Your Meds Without the Stress

Here’s how to make this system work for you:

- Know your state’s formulary. Visit your state’s Medicaid website. Look for “Preferred Drug List” or “Formulary.” North Carolina’s is updated in January, July, and October.

- Ask your pharmacist. They see what’s covered every day. If your drug is denied, ask if there’s a preferred alternative.

- Get your doctor to document everything. If you need an exception, your doctor’s note must include why step therapy won’t work - not just “patient needs it.”

- Use in-network pharmacies. Mail-order pharmacies often offer lower copays for maintenance meds. Check your plan’s list.

- Appeal denials. If you’re denied, appeal. With full documentation, you have a high chance of winning.

And if you’re overwhelmed? Call your State Health Insurance Assistance Program (SHIP). They offer free, one-on-one help. Most beneficiaries need about three sessions to fully understand their coverage.

The Bigger Picture: Why This System Exists

Medicaid spends $64.3 billion a year on prescription drugs - nearly 10% of its entire budget. Generics make up 89% of prescriptions but only 27% of costs. Specialty drugs? Just 3% of prescriptions, but 42% of spending. That’s why states focus so hard on controlling those high-cost drugs.

Drug manufacturers pay billions in rebates to Medicaid through the federal Drug Rebate Program. States use those rebates to negotiate lower prices. But if a drugmaker refuses to offer a big enough discount, the state drops it. It’s not about medical need - it’s about budget math.

Still, the system is improving. In 2025, Medicaid beneficiaries can change their drug plans once a month - not just during a yearly enrollment window. And new federal rules coming in 2026 will require states to prove their formularies don’t block medically necessary care.

For now, the best thing you can do is stay informed. Know your formulary. Ask questions. Advocate for yourself. And if you’re struggling to pay for meds, you might be eligible for more help than you think.

Does Medicaid cover all prescription drugs?

No. Medicaid covers most outpatient prescription drugs, but each state creates its own list of covered medications called a Preferred Drug List (PDL). Some drugs are excluded entirely, especially those that don’t offer enough rebate to the state or are considered non-essential. Over-the-counter drugs, weight-loss medications, and fertility treatments are rarely covered.

Why do I have to try other drugs before Medicaid covers mine?

This is called step therapy, and it’s required in 38 states to control costs. Medicaid makes you try cheaper, preferred drugs first. If they don’t work or cause side effects, your doctor can submit a prior authorization request with clinical proof that you’ve failed those options. This doesn’t mean you’re being denied care - it means the system is designed to use lower-cost alternatives before approving more expensive ones.

How do I know if my drug is covered?

Check your state’s Medicaid website for the current Preferred Drug List. You can also ask your pharmacist - they have real-time access to coverage rules. If your drug is denied at the pharmacy, ask for a formulary exception form and work with your doctor to complete it with clinical documentation.

Can I get help paying for my Medicaid prescriptions?

Yes. If you’re on full Medicaid, you automatically qualify for Extra Help - a federal program that caps your copays at $4.90 for generics and $12.15 for brand-name drugs. Once you hit $2,000 in annual drug costs, you pay nothing for the rest of the year. You don’t need to apply - it’s automatic.

What if my drug was removed from the formulary?

If your drug was removed, your state likely stopped receiving a rebate from the manufacturer. You can ask your doctor for a prior authorization request with clinical justification. If approved, you may still get it covered. Otherwise, your doctor may switch you to a similar, covered medication. Always check your state’s latest formulary updates - changes happen several times a year.

Are mail-order pharmacies better for Medicaid prescriptions?

Often, yes. Many Medicaid plans offer lower copays for maintenance medications (like blood pressure or diabetes drugs) when filled through mail-order pharmacies. You typically get a 90-day supply for the price of a 30-day retail fill. Check your plan’s network list to find approved mail-order providers.

15 Comments

Richard Wöhrl

November 24, 2025 at 14:36 PM

Just to clarify - Medicaid’s formulary changes are driven by rebate agreements, not clinical efficacy. That’s why drugs like Trulance got axed: the manufacturer stopped offering a big enough discount. It’s not that they’re unsafe - it’s that the math didn’t add up for the state. This is why knowing your state’s formulary updates (Jan, July, Oct) is critical. Pharmacies often don’t update in real time, so always double-check.

Also - Extra Help is automatic. If your copay is under $5 for a generic, you’re already enrolled. No application needed. Millions miss this because no one tells them. Check your receipt. If it’s not $4.90, call SHIP.

And step therapy? It’s not evil - it’s cost control. But when doctors submit detailed clinical notes, 78% of denials get overturned in NC. Documentation is your weapon. Use it.

Katy Bell

November 26, 2025 at 09:13 AM

I had to appeal for my sister’s epilepsy med last year. Took 14 days. She ran out. Had a seizure. The system doesn’t care about your timeline. It cares about forms. My brother-in-law works at a pharmacy - he says 60% of prior auths get denied on the first try, not because the drug isn’t needed, but because the doctor’s note didn’t use the right buzzwords. It’s a language game. Learn it or suffer.

Adrian Rios

November 27, 2025 at 13:30 PM

Look - I get why states do this. Medicaid spends $64 billion a year on drugs. 42% of that goes to 3% of prescriptions - specialty meds. So yeah, they gotta control that. But here’s the thing: they’re not controlling abuse. They’re controlling access for people who literally can’t afford to go without. I’ve seen people skip doses to make their insulin last. I’ve seen people cry in the pharmacy because their migraine med got pulled. This isn’t fiscal responsibility - it’s moral negligence wrapped in a spreadsheet.

And don’t even get me started on Ozempic. If you’re obese and diabetic, that drug saves your life. But Medicaid won’t touch it unless you’re in a clinical trial? That’s not healthcare. That’s punishment. We treat addiction like a disease, but weight? Nah. That’s laziness. That’s the real bias here.

And the fact that we don’t cover OTCs like ibuprofen unless you have a script? That’s absurd. You think a 72-year-old with arthritis is calling their doctor every time their knee flares up? They just suffer. Or they buy it with cash. And if they can’t afford cash? They don’t take it. That’s the system. It’s designed to make you suffer before you’re worthy of help.

It’s not broken. It’s working exactly as intended: to make the poor jump through hoops so the rich don’t have to pay more.

Suresh Ramaiyan

November 28, 2025 at 11:12 AM

There’s a quiet irony here - the very people who benefit most from Medicaid are the ones least equipped to navigate its bureaucracy. Elderly, disabled, mentally ill, non-English speakers - they’re the ones who need help the most, but the system demands they become legal experts just to get a pill. We call this 'cost containment.' I call it 'systemic cruelty disguised as efficiency.' We need advocates, not audits.

And the fact that 1.2 million people don’t know they’re getting Extra Help? That’s not a gap in awareness - that’s a failure of outreach. Someone should be knocking on doors, not waiting for people to Google 'Medicaid formulary.' This isn’t a consumer product. It’s a lifeline.

Lisa Detanna

November 28, 2025 at 16:41 PM

As someone who’s been on Medicaid for 12 years, I’ve seen every trick. Step therapy? I’ve been forced to try 5 antidepressants before they let me on the one that actually works. My doctor had to write a 3-page letter with lab results, therapy notes, and a letter from my therapist. They approved it on the 4th appeal. Took 6 weeks. I went without. I lost my job. Don’t tell me this system is 'fair.' It’s a trap for the desperate.

But here’s what no one says: if you have a good doctor who fights for you, you can win. My doc is a warrior. She calls the state directly. She knows the case managers. She sends handwritten letters. That’s the secret. It’s not the system - it’s the people behind it. Find your advocate. Be relentless.

John Mackaill

November 29, 2025 at 12:26 PM

From the UK perspective, this is wild. We have the NHS - drugs are free at point of use. Yes, there are restrictions, but they’re clinical, not financial. If your doctor says you need it, you get it. No tier lists. No rebates. No paperwork. The cost is absorbed at the national level. It’s not perfect, but it’s human. Here, it feels like your medicine is a privilege you have to earn by surviving bureaucracy.

It’s not about money - it’s about values. Do we believe healthcare is a right? Or a reward for being good at paperwork?

Jennifer Shannon

November 29, 2025 at 17:06 PM

I just want to say - if you’re reading this and you’re struggling - you’re not alone. I’ve been there. I had to fight for my rheumatoid arthritis drug for 8 months. I called SHIP. I emailed my rep. I posted in Reddit groups. I cried in the pharmacy parking lot. But I kept going. And I won. You can too. The system is rigged, but it’s not unbeatable. Your voice matters. Your doctor’s voice matters. Keep pushing. And if you feel like giving up? Come back here. We’ll help you pick up the pieces.

Casper van Hoof

December 1, 2025 at 03:40 AM

One must interrogate the epistemological foundations of pharmaceutical policy: if health outcomes are the metric, then cost-containment via formulary restrictions is a misaligned incentive structure. The state, as agent of the collective, is optimizing for budgetary equilibrium rather than biological integrity. The result is a tragicomic inversion - where the most vulnerable are penalized for their vulnerability, and the most profitable drugs are shielded from scrutiny. This is not policy. It is political economy masquerading as public health.

shreyas yashas

December 2, 2025 at 05:55 AM

Bro, I’m from India and I’ve seen how things work here - if you can’t afford medicine, you don’t get it. Full stop. But here, you *can* afford it… kinda. You just gotta jump through 17 hoops, beg your doctor to write a novel, and hope the state feels like it today. At least in my village, people just share pills. No forms. No denials. Just human stuff.

Y’all got a system that’s supposed to help but makes you feel like a criminal for needing help. That’s messed up.

Demi-Louise Brown

December 3, 2025 at 11:56 AM

The formulary changes are published quarterly and accessible online.

Brandy Walley

December 4, 2025 at 01:48 AM

Why should I get free drugs when I work two jobs and still can’t afford rent? Medicaid is for lazy people who don’t want to work. If you’re poor, get a better job. Stop expecting the government to hand you pills like candy. I pay taxes for this? No thanks.

Henrik Stacke

December 4, 2025 at 10:41 AM

It is, in fact, a matter of considerable concern that the administrative burden placed upon both patient and provider in securing essential therapeutics has become so onerous as to constitute a de facto denial of care. The notion that clinical decision-making should be subordinated to rebate schedules is not only ethically indefensible - it is medically unsound. One might reasonably posit that the integrity of the physician-patient relationship has been compromised by the intrusion of fiscal intermediaries who lack clinical training, yet wield decisive authority over therapeutic access.

It is, perhaps, a paradox of modern healthcare that the most vulnerable among us are required to navigate a labyrinth designed not for healing, but for cost avoidance.

Kezia Katherine Lewis

December 4, 2025 at 23:28 PM

Formulary management is a subset of utilization management strategies designed to optimize therapeutic outcomes while controlling pharmaceutical expenditures through tiered formularies, step therapy protocols, and prior authorization requirements - all aligned with CMS guidelines under 42 CFR 430. The key is adherence to evidence-based criteria and rebate compliance thresholds. States are required to demonstrate that formulary exclusions do not impede access to medically necessary services - which is why appeals processes exist.

It’s not about denying care. It’s about stewardship.

Pramod Kumar

December 5, 2025 at 04:42 AM

Man, I’ve seen this in my cousin’s life - she’s got bipolar, takes lithium, and Medicaid made her try five other mood stabilizers first. Five. One gave her kidney stones. Another made her hallucinate. But they said ‘try again.’ She almost died. Her doctor finally wrote a letter that said ‘if she tries another one, she might not wake up.’ They approved it after 10 days. She cried when she got it. I cried with her. This ain’t policy. This is torture dressed in paperwork.

And the worst part? No one’s talking about the people who just give up. The ones who don’t call, don’t appeal, don’t fight. They just stop taking it. And no one ever hears from them again.

Matthew Mahar

November 23, 2025 at 02:15 AM

So let me get this straight - if I need a drug that costs $500 a month but there's a $5 generic that 'technically' does the same thing, I gotta fail on the $5 one first? What if the $5 one gives me hallucinations? My doctor says no, but Medicaid says 'try again' - like this is some kinda drug roulette. This ain't healthcare, it's a bureaucratic obstacle course with my life on the line.